Liquify are official Shopify Experts & Partners since 2014. If you follow a link to Shopify from our website and make a subsequent purchase this may result in a commission at no extra cost to you. Our opinions remain our own.

What is PCI DSS?

In today’s digital age, e-commerce is booming, and Shopify has emerged as one of the leading platforms for online businesses. However, as an online merchant, you must ensure that your customer’s sensitive payment information is handled securely. This is where PCI DSS (Payment Card Industry Data Security Standard) compliance comes into play.

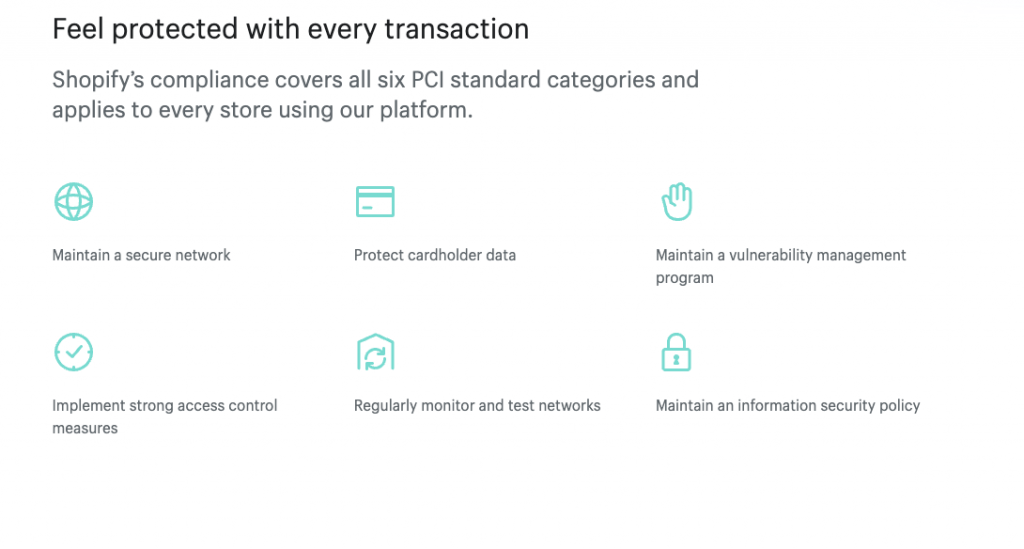

PCI DSS is a set of security standards designed to ensure the secure handling of credit card information during online transactions. Developed by the Payment Card Industry Security Standards Council, PCI DSS consists of 12 high-level requirements, each containing specific sub-requirements. Compliance with these standards is essential for any business that accepts credit card payments, as non-compliance can lead to hefty fines, reputational damage, and, most importantly, compromised customer trust.

Shopify and PCI Compliance

Shopify, as a leading e-commerce platform, places a strong emphasis on security, and is PCI compliant. However, it’s essential to understand that PCI compliance is a shared responsibility. While Shopify provides a secure framework, it is your responsibility, as a merchant, to manage for example any payments processed over the phone in a secure way.

Here are some key aspects of Shopify’s approach to PCI compliance:

Shopify’s Security Measures: Shopify employs robust security measures to protect your customers’ data, including SSL encryption, data encryption at rest, and regular security audits. The checkout steps where payment data is modified are locked and can only be modified in limited ways on Shopify Plus which prevents data leakage. Many people see the inability to change the checkout as a disadvantage but given that the upside is PCI compliance it really makes sense. For those who have never had to worry about PCI compliance it is zero fun and can suck up a whole load of time.

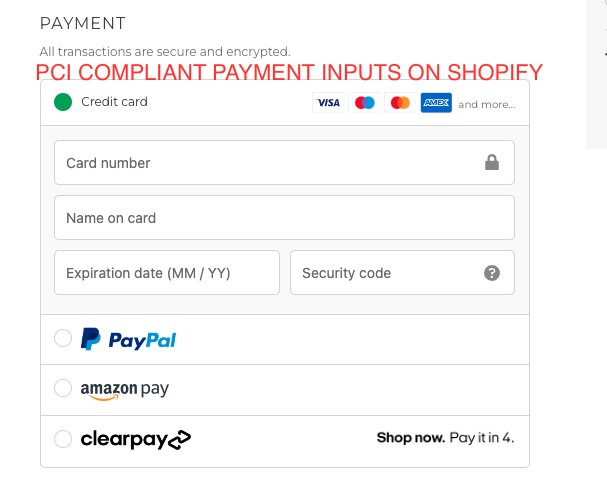

Use of Third-Party Payment Processors: Shopify encourages the use of trusted third-party payment processors like Shopify Payments, PayPal, and Stripe, which are responsible for handling payment data securely either on or off site, reducing your own PCI compliance requirements.

Self-Assessment Questionnaires (SAQs): Shopify merchants can complete SAQs to assess compliance requirements. The SAQ type depends on your specific payment setup and processing methods.

Limiting Access: Shopify restricts access to sensitive cardholder data, and you, as the merchant, have limited control over the storage and transmission of such data.

By default Shopify takes care of PCI compliance when orders are processed through the checkout by the customer. But there are instances where PCI compliance needs to be looked at for example if processing card orders over the phone, saving customer card data in any way or recording an interaction where card data is being transferred.

Liquify and Shopify PCI Compliance

Achieving and maintaining PCI compliance can be a complex and daunting task for many online businesses. This is where our Shopify experts can help with PCI compliance if you believe you need some additional layers of security:

Configuration and Setup: our Shopify experts can ensure your store is correctly configured to meet PCI requirements, reducing the risk of non-compliance. Ensuring checking any apps which for example may store card data or tokenized data.

Custom Development: We can develop custom solutions to enhance your store’s security, such as integrating additional security measures and features to meet specific compliance needs for example in instances where card details need to be entered over the phone or stored temporarily.

Regular Audits and Maintenance: We can conduct regular security audits, implement security patches, and keep your store up to date with the latest security practices at all levels.

Education and Training: We can educate you and your team on best practices for handling payment data and maintaining compliance.

Want to Know More?

In the world of e-commerce, ensuring the security of your customer’s payment data is paramount. Shopify takes PCI compliance seriously and offers a secure platform for online merchants. However, achieving and maintaining compliance requires a collaborative effort and some more advanced stores may need additional support to maintain PCI compliance (although the vast majority will be PCI compliant from day 1).

If you’re looking for professional assistance in achieving PCI compliance for your Shopify store, or any kind of security audit contact our expert Shopify Plus development team. We have the experience and knowledge to help you navigate the complexities of PCI DSS and ensure that your online business remains secure and compliant. Your customers’ trust and your business’s reputation are worth the investment in PCI compliance.